When Will Mortgage Rates Finally Come Down?

One of the hottest topics in the housing market today is: When will mortgage rates decrease? After years of increasing rates and a rollercoaster ride throughout 2024, many buyers and sellers are eager for some relief.

While it’s impossible to predict mortgage rate trends with complete accuracy, experts are sharing valuable insights about what we might expect in the coming year. Here’s the latest on where rates could be headed.

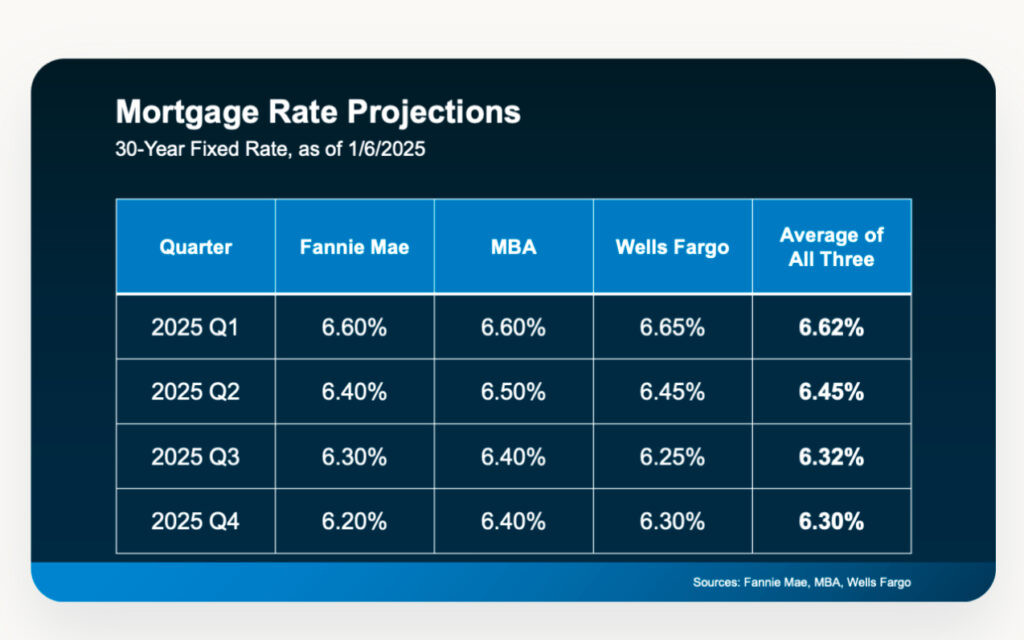

Mortgage Rates Are Expected To Ease and Stabilize in 2025

After a period of significant volatility, the most recent forecasts indicate that mortgage rates should begin to stabilize in the next year. While they may remain higher than in recent years, there’s hope for a gradual easing compared to today’s levels.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains: “While mortgage rates remain elevated, they are expected to stabilize.” This stabilization would offer some much-needed consistency for buyers and homeowners alike, making it easier to plan for housing costs.

What Influences Mortgage Rates?

Mortgage rate movements are among the most complex aspects of the housing market to predict because they depend on several economic factors working in tandem. Here’s a breakdown of the key drivers shaping the future of rates:

- Inflation: Inflation plays a critical role in mortgage rates. If inflation slows down, we could see rates dip slightly. However, if inflation remains high or spikes, rates may stay elevated for a longer period.

- Unemployment Rates: The unemployment rate impacts decisions made by the Federal Reserve. While the Fed doesn’t set mortgage rates directly, its actions influence the broader economy, which in turn affects rates.

- Government Policies: Changes in fiscal and monetary policy—especially with a new administration taking office in January—could have a significant impact on financial markets and mortgage rates.

While forecasts suggest rates may come down slightly, it’s important to remember that economic conditions are always changing. Mortgage rates will likely continue to fluctuate as new data becomes available.

How To Prepare While Mortgage Rates Are Still High

Rather than trying to time the market, focus on actions that are within your control. These proactive steps can position you for success, regardless of where rates head next:

- Boost Your Credit Score: A higher credit score can help you qualify for better loan terms and lower interest rates.

- Save for a Down Payment: Putting aside extra funds now can help reduce your loan amount and monthly payments when you’re ready to buy.

- Automate Your Savings: Consistent, automatic savings can make it easier to reach your financial goals without needing to think about it.

Final Thoughts: Stay Informed, Stay Prepared

While no one can predict exactly when mortgage rates will drop, the best way to stay ahead is by being informed and prepared. Keep an eye on market updates and focus on what you can do today to make your homeownership dreams a reality.

If you’re considering buying or selling a home, let’s connect! I’d be happy to provide personalized advice tailored to your goals and help you navigate this ever-changing market.

Vittoria Logli Top Realtor, Glenview IL